Rough start for equity markets in 2022

If you pay any attention to such things, you have surely heard news stories blaring about the dramatic drop in the U.S. stock market to start the year (at the time of going to press, the S&P 500 had fallen more than 20% from its high), high inflation, and fears of a recession on the horizon.

What’s going on?

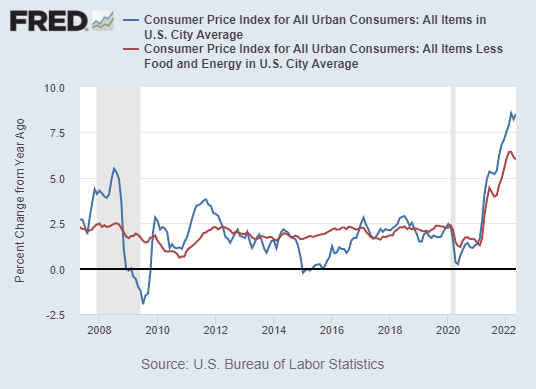

- Let’s start with Inflation. The consumer price index rose 8.6% in May, the highest rate since 1981 according to CNBC. There are many potential culprits for this. Moody’s provides a useful list in the accompanying table and places most of the blame on the war in Ukraine and COVID.

Why is inflation a problem?

- Obviously, no one likes to pay more for stuff and higher prices this year have been very noticeable in the supermarket and at the gas station.

- It can feed on itself as current high inflation creates expectations of high future inflation which can become a self-fulfilling prophecy.

- Relatively high inflation makes business planning more difficult as it makes the future costs of inputs and labor uncertain. (Target’s recent announcement that it will offer many consumer durables on sale due to too much inventory may be partially due to inflation and related supply chain disruptions.)

What is the role of the Federal Reserve? The Federal Reserve has a statutory obligation to pursue the dual objectives of maximum employment and stable prices. The Fed’s stated average inflation target is 2.0%.

Because the target is an average, the Fed will tolerate inflation below and above 2.0% for some (not formally defined) periods of time, but (it appears that) they don’t want to see 8.0% for any length of time. So, the Fed is aiming to lower inflation by:

- Raising the federal funds rate and

- Stopping the purchase of Treasury and agency securities.

Roughly speaking, each of these actions is expected to increase interest rates, decrease economic activity which is expected to lead to lower inflation.

- Which finally brings us to the U.S. stock market. Higher interest rates, or the expectation of higher interest rates, lead to lower stock prices because the calculated fair value of those companies (by stock analysts for example) goes down. This mechanism is more pronounced with growth stocks (versus value stocks).

Indeed, year-to-date (May 31) while the overall large company index Russell 1000 lost 13.72%, Growth lost 21.88% as compared to Value which only lost 4.52%.

In addition, many people worry that the Fed will overshoot its target and slow economic activity so much that we fall into a recession (negative economic growth). A recession would lower corporate earnings and further weigh on the outlook for stock.

Returns of three different U.S. Stock Market Indexes as of May 31, 2022

|

|

YTD |

One Year |

Three Year (annualized) |

|

Russell 1000 Growth TR |

-21.88% |

-6.25% |

18.31% |

|

Russell 1000 TR |

-13.72% |

-2.71% |

16.03% |

|

Russell 1000 Value TR |

-4.52% |

0.93% |

12.7% |

- A final observation: While losses and volatility in equities year-to-date may be trying your resolve, try putting things in perspective. True - returns in the market this year have roughly wiped away a full 12-months of gains. But, even including that loss, the Russell 1000 has gained an annualized 16% over the last three-year period. This rate is well above the annualized average return of 10.5% (for the S&P 500, which tracks a similar set of securities as the Russell 1000) between 1957 and 2021.

sources:

Inflation rose 8.6% in May, highest since 1981,

https://www.cnbc.com/2022/06/10/consumer-price-index-may-2022.html;

Guide to Changes in Statement on Longer Run Goals Monetary Policy Strategy, as amended on August 27, 2020, https://www.federalreserve.gov/monetarypolicy.htm;

Monetary Policy Report – February 2022,

What is the Average Annual Return for the S&P 500?, https://www.investopedia.com/ask/answers/042415/what-average-annual-retu...